Table of Content

With a variety of coverages, and plenty of ways to save, you can create a policy that keeps your home safe and fits your budget. Homeowners insurance can help you protect your home and belongings. Whether your home is damaged, your belongings are stolen, or someone is injured on your property, homeowners insurance can help.

Some people turn to insurance comparison sites to look for the cheapest insurance, but that’s not always the best way as price is not the only thing you should consider. The policies you’ll be offered are usually fairly generic and may not meet your individual requirements. MGA brokers can arrange insurance cover on your behalf and provide advice on how to make the most of your insurance budget. With over 30 years ‘insurance for builders’ experience ‘The Builders Insurance Broker’ is the preferred insurance broker for construction and trades businesses of all sizes. With both an auto and renters policy, you could earn a multi-policy discount.Δ Plus, you'll enjoy the convenience of having both policies under the same roof. Quote now to enjoy the extra savings and ease of bundled insurance.

DISPLAY HOMES INSURANCE

With a range of coverages and deductible options to choose from, you can easily create an insurance policy that protects your mobile home and works with your budget. Even if you don't have a mortgage on your property, a homeowners policy may be valuable in protecting against damage to your property and belongings. Offers to receive quotes are advertisements from certain participating insurance providers that pay Zillow, Inc a fee to appear in this list or receive consumer contact information, like yours. Zillow provides this sponsored content as a resource and does not recommend or endorse any insurance provider.

I was directed to app to sign documents after calling the 800 number. You may qualify for a discount when you purchase a new home (doesn't have to be newly built). With our “A – Exceptional” financial stability rating, we can help our customers through everything – from everyday claims to catastrophes.

Choose from over 30 other products

Annual premium for a basic liability policy and is not available in all states. Hit the highway with the coverage you need for peace of mind. Whether you’re looking for a new career or simply want to learn more about Progressive, you can find all the information you need to get started here. Our coverage is designed to fit your home, needs, and budget. After discovering an insurance-buying process that was actually pleasant, a homeowner in Sanford, Florida, wants everyone she knows to switch to Kin.

If you're unable to stay in your home during repairs due to a covered loss, additional living expenses may pay for additional living expenses above what you'd typically pay, up to your policy's limits. We offer protection for your home and personal property in addition to liability coverage if you're responsible for another person's injury or damage to their property. Most insurance policies will automatically renew after the 6- or 12-month term. However, many factors can affect your coverage needs and cost, so performing a double check is always a good idea.

Find insurance coverage for other types of property.

We provide insurance for a wide range of commercial vehicles, including trucks, trailers, cars, SUVs, and more. Start your quote today and give yourself peace of mind while on the clock. From general liability to cyber insurance, you can find the coverages you need to protect your company from severe financial loss. Start a quote today and safeguard your business from the unexpected.

There is also the option to add flood cover to the policy. Glass, both internal and external, is covered against damage. The policy also provides Public Liability cover for you as the property owner. This lease period can often be anywhere between 1 and 3 years.

Our experienced agents can help you with any paperwork and to manage your policy. Call us if you have any questions about this valuable coverage. The dwelling itself is usually protected under Category A homeowners insurance. Yes, you can pay for your insurance online through several different payment methods.

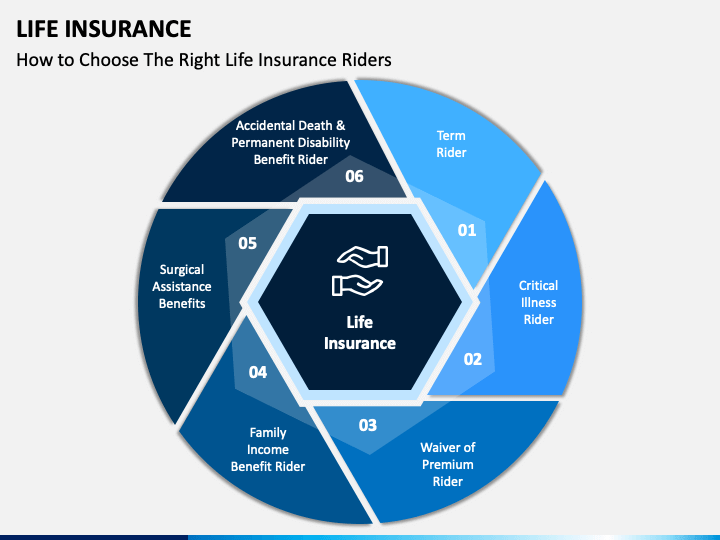

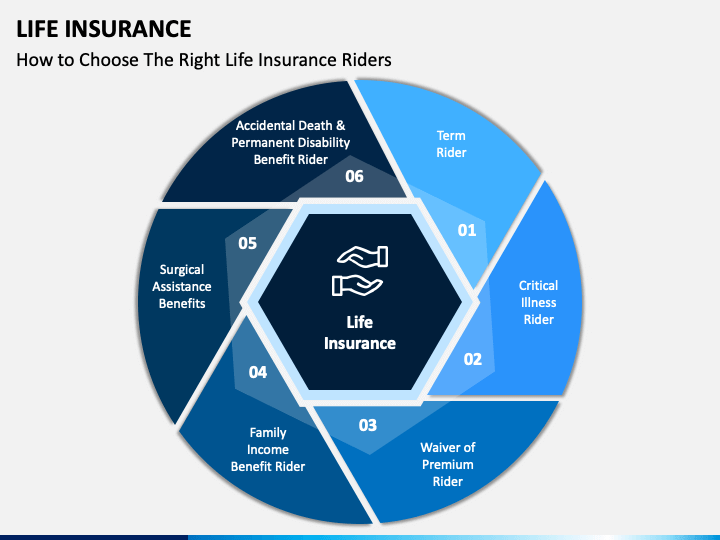

This policy provides the rental income that you are missing out on during this time. Term life insurance can provide you and your family with long-lasting financial security. You determine how much coverage you need, how long you need it, who you’d like covered, and when you pay—giving you control of your policy. Personal liability coverage helps protect your assets if you or your family members are liable for someone else's damage or injuries. Additional coverages may be available to purchase for libel, slander, and other lawsuits.

Join us today and experience why we're one of the best insurance companies. We offer insurance by phone, online and through independent agents. Dwelling coverage may pay to repair or rebuild your house caused by fire, severe weather, falling trees, ice dams, and other covered perils. However, if you have a mortgage, it is rather common for mortgage companies to include your homeowners insurance premium in your mortgage’s escrow account.

You can often see savings through discounts such as having more than one policy with the same insurer or being loss free. A standard homeowners insurance policy provides coverage to repair or replace your home and its contents in the event of damage. That usually includes damage resulting from fire, smoke, theft or vandalism, or damage caused by a weather event such as lightning, wind, or hail. Some Business Owners policies are underwritten by Progressive. These guidelines will determine the company quoted, which may vary by state. The company quoted may not be the one with the lowest-priced policy available for the applicant.

Generally speaking, homeowners insurance policies do not cover damage caused by earthquakes or floods. If you need coverage for these perils, you will need to inquire whether you need to purchase a separate policy or if your policy can be endorsed to add the coverage. Additionally, standard homeowners policies have exclusions and / or limited policy limits for certain types of loss or damage. A home is a big investment, so it is a good idea to buy home insurance to protect it, but unlike some other insurance, it is generally not required by law.

Something else to consider, most homeowners insurance policies don't cover flood damage. They may be a multi agent where they provide covers from several providers, but they continue to only sell products from those insurers. Progressive has the coverages you need to protect your vehicles on the road and at the job site.

No comments:

Post a Comment